95% of crypto investors fail because of their own brain, that’s the culprit. It’s not the whales manipulating the price that keeps us from succeeding; It’s their own thinking or rather our cognitive biases that push us to make poor decisions. Everyone has these no matter how smart logical or experienced you are; It’s part of our human condition. The good news is that these biases are very well known. You can avoid them if you’re able to spot them and know how to resist them.

Unit Bias

People would rather own a whole unit of something rather than a fraction of it. A great example is if you feel better about owning 10,000 of some meme coin rather than 0.1 of a Bitcoin. The problem with this is that owning a large quantity of something may make you feel good, but that says nothing about the underlying value or growth potential of that coin. If bitcoin goes up 10% while the meme coin only goes up 2%, then your 0.1 of a Bitcoin would have made you more money.

The point here is to not just look at the raw price of a coin and how many you can buy. You have to factor in things like their market cap and make a projection of how much that could grow in the future.

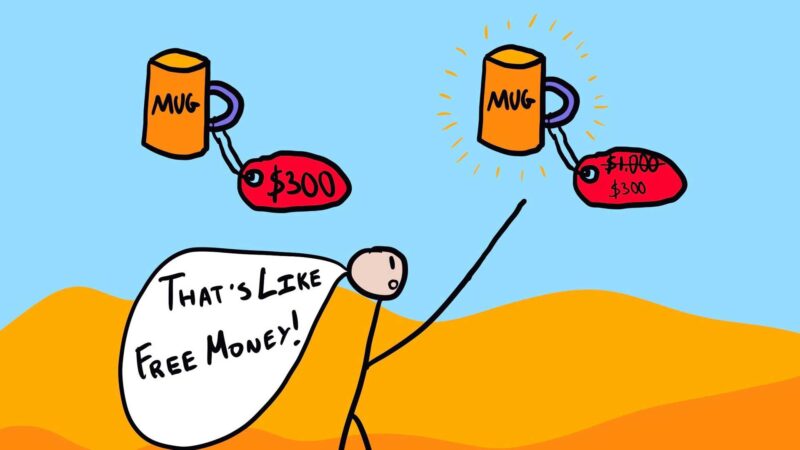

Anchoring Bias

We put too much importance on the first piece of info that we learn about a coin or project. Let’s say you discover SOL after it already rocketed 3x. You may be thinking “Dang I missed out on the rocket ship, it went up too much already.” You end up not buying it but then it rockets 10x more on top of that. You missed out on all those gains, and it turns out you weren’t even that late when you first discovered it.

This has happened to me so many times before. Thinking I’m too late because I discovered a project after it had already rocketed. The right approach here is to evaluate it based on its future potential, not on its past behavior.

Confirmation Bias

We only look for info that tells us what we want to hear. An example of this is closing our ears and screaming “but…” when we hear something that goes against our favorite project. Another example is if we only follow influencers who tell us what we want to hear, and we block the ones that we disagree with. This gets dangerous because what we want to hear is not always the truth.

Sometimes it is indeed FUD but not always. You have to be open-minded and willing to do your own independent research to tell one from the other. The point here is to not get married to your investments and to really strive to get to the truth, which can only help you make better investment decisions.

Sunk Cost Fallacy

We hold on to losing positions just because we’ve already invested so much time, money, or effort in it, even if the costs outweigh the benefits. A common example is if we hold a coin through a bear market and we’re like “Dang it’s down so much already. Let’s just hold on to it until it recovers.”

What if, we sell that coin and buy something else that’s more promising and recovers even faster? That would be the more financially savvy move instead of just saying “Oh well I’ve waited so long and invested so much that I’m gonna ride with it.” My point here is that you have to constantly reconsider the opportunity cost in order to make the best decisions.

Loss Aversion

This is the common psychological behavior, where we feel more pain from losing then we feel pleasure from winning or gaining something. A great example of this comes from my own experience, I encountered some scam or rug pull ICOs back in 2017. I vowed never to do token sales again because I hated that feeling and wanted to avoid rugs at all costs. But If I was more open-minded like my buddy and bought some in 2019-2020, I would have gotten massive returns without even facing that many rug pulls.

The point here is that we should always ask ourselves, what’s the worst thing that could happen if we took this action? and what’s a realistic probability of that coming true? Sometimes the risk reward calculus is better than we think; It’s our loss aversion that’s irrationally keeping us from doing something.

Recency Bias

We put more weight on recent information/events than they deserve. Let’s say we noticed that in the past few months, some on-chain or TA metric flashed and then Bitcoin proceeded to rocket right afterwards. You’re like “Okay it just happened again so i’m gonna bet big this time. It worked all the previous times so why not this time” Then it proceeds to fail and Bitcoin dumps instead and you get wrecked.

This is actually basic statistics like if we’re in a casino and we notice a roulette table has been hitting a long string of greens, then we think that it’s a greater odd of being green next, even though that’s definitely not the case. The point here is that we need to zoom out and look at more complete data, to make sure that we’re actually building a solid statistical case, rather than cherry picking data to inform our views.

Survivorship Bias

We only study the winners or survivors and try to copy them to recreate their success, even though it may have been blind luck. We all hear about someone buying a few thousand dollars’ worth of meme coins and becoming a multi-millionaire in a few months, but we don’t hear about the thousands of people who bought meme coins and lost a ton of money.

It’s a fool’s game to try to copy the winners without studying the losers as well. The problem here is that sometimes it’s harder to notice or get information about the losers, and that’s why this bias is so prevalent.

Authority Bias

This is simple, it’s our tendency to follow the leader or authority figure. For example, if you’re like “Wow! this analyst has been around since 2015 and they have a million followers on twitter. They must be super legit and have a great track record.” then you follow their trading calls, and it turns out wrong and gets you wrecked.

Like PlanB for example, so many people followed his stock to flow model, and swore by his crazy 120k Bitcoin by December prediction. Point is you got to realize that authority figures get it wrong too, so don’t take their word as gospel. Also, be sure to ask yourself what their motivation or incentives is to say what they’re saying. Oftentimes we need to take their word with a grain of salt and come to our own decisions instead.

Outcome Bias

This is where you judge a decision based on the final outcome that happened, rather than separating the quality of your decision from the eventual outcome. One example is if you FOMO into a random meme coin and then it goes 10x. That is amazing for you but a terrible decision, the reason why is because if you do those nine more times, it may all fail and get you losses instead. When evaluating the result, you have to account for randomness or variance that could explain it.

Herd Mentality

This is where we like to follow and copy what everyone else is doing. Like “Oh wow! Everyone is buying these NFT collections so I gotta do it too.” This type of FOMO behavior could lead you to “buy the top” in many instances. You really want to do your own clear-headed analysis rather than get sucked in by emotion too much.

Now that we’ve identified these common biases, the question becomes how we resist them. One thing you can do is to print out a checklist of these 10 biases, along with all the other ones out there. Go through them every time you want to make some investment decision, like whether or not to buy some coin you just heard about. After you refer to it enough times, it will become more muscle memory.

The next thing you could do is to create a trading or investing framework for yourself. You set your own rules, like in what situations do you buy something, and in what situations do you avoid or wait. Just follow that to a tee so it’s not left up to your gut feeling on any given day.

But of course, you can adjust that over time. Like if you notice a string of underperformance, you can review your system, and make changes as need be. No system is perfect after all and it’s all about iterating to make it work for you. Related to that it’s just keeping a journal of good and bad moves to see what you can learn from in the past.